2026 Inflation Reduction Act: 5 Key Renewable Energy Tax Credits for U.S. Homeowners

The 2026 Inflation Reduction Act provides substantial financial incentives for U.S. homeowners to adopt renewable energy solutions, making sustainable home improvements more attainable and cost-effective.

Are you a U.S. homeowner considering a leap into sustainable living? Navigating the 2026 Inflation Reduction Act: 5 Key Renewable Energy Tax Credits for U.S. Homeowners can significantly reduce your costs for eco-friendly home upgrades, making renewable energy more accessible and affordable than ever before.

Understanding the Inflation Reduction Act (IRA) and Homeowner Benefits

The Inflation Reduction Act (IRA), signed into law in August 2022, represents a landmark piece of legislation designed to combat inflation, lower prescription drug costs, and, crucially for homeowners, invest heavily in climate change initiatives. For U.S. homeowners, the IRA offers an unprecedented array of tax credits and rebates aimed at making homes more energy-efficient and powered by renewable sources.

This act extends and enhances several existing tax credits while introducing new incentives, significantly reducing the financial burden associated with installing renewable energy systems. The goal is to accelerate the transition to a clean energy economy, lower utility bills for households, and decrease carbon emissions across the nation. Understanding these provisions is vital for maximizing your savings and contributing to a more sustainable future.

The IRA’s Vision for Residential Energy

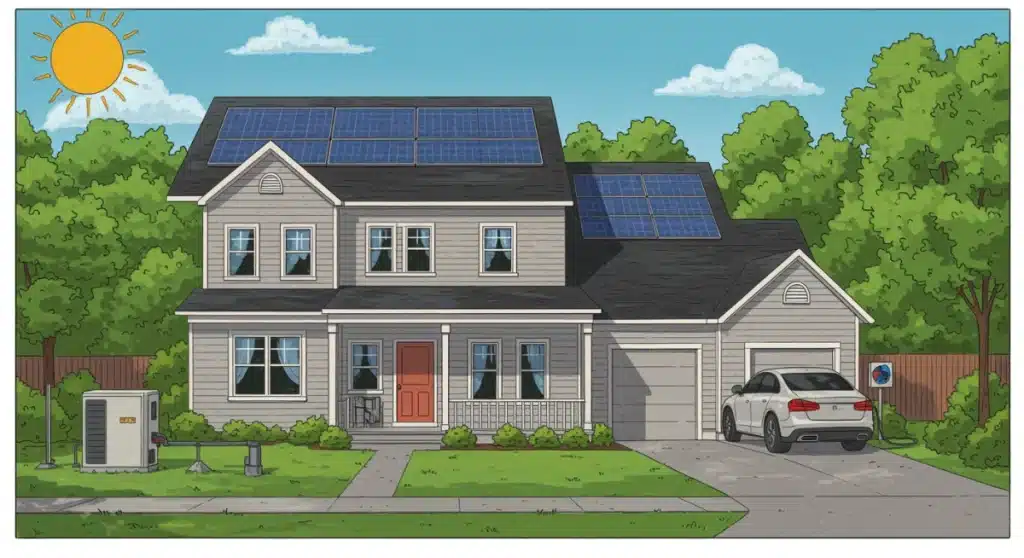

The IRA’s vision for residential energy is clear: empower homeowners to embrace clean energy by making it economically advantageous. This includes a broad spectrum of technologies, from solar panels to heat pumps, electric vehicles, and battery storage. The legislation acknowledges that upfront costs can be a significant barrier to adoption, and by offering generous tax credits, it seeks to overcome this hurdle.

- Long-term Savings: Reduced energy bills translate into substantial long-term financial benefits.

- Environmental Impact: Decreased reliance on fossil fuels lowers your carbon footprint.

- Increased Home Value: Energy-efficient homes often command higher resale values.

In essence, the IRA transforms home energy upgrades from a luxury into an accessible and financially savvy investment. By educating yourself on the specific tax credits available, you can make informed decisions that benefit both your wallet and the planet.

The Inflation Reduction Act is a comprehensive framework that supports homeowners in their journey towards energy independence and sustainability. Its provisions are designed to be user-friendly, encouraging widespread adoption of renewable energy technologies and energy-efficient home improvements. This foundational understanding sets the stage for exploring the specific tax credits that directly impact U.S. homeowners.

The Residential Clean Energy Credit (Section 25D)

One of the most impactful provisions for homeowners under the Inflation Reduction Act is the Residential Clean Energy Credit, often referred to as Section 25D. This credit provides a significant financial incentive for installing eligible renewable energy systems in your home, directly reducing your federal income tax liability. It’s a non-refundable credit, meaning it can reduce your tax bill to zero, but you won’t get a refund of any excess credit.

For systems placed in service from 2022 through 2032, the credit amount is 30% of the cost of new, qualified clean energy property for your home. This generous percentage makes a substantial difference in the overall cost of these often-expensive installations. The credit is available for both existing homes and newly constructed homes, and it applies to both your primary residence and a second home.

Eligible Technologies Under Section 25D

The scope of eligible technologies under the Residential Clean Energy Credit is broad, covering several popular renewable energy solutions. This ensures that homeowners have a variety of options to choose from, catering to different needs and geographical locations. Understanding what qualifies is the first step in claiming this valuable credit.

- Solar Electric Property: This includes solar panels that generate electricity for your home. Both purchased systems and those financed through loans qualify.

- Solar Water Heating Property: Systems that use solar energy to heat water for residential use. A crucial requirement is that at least half of the energy used to heat water must come from solar.

- Geothermal Heat Pump Property: These systems use the earth’s stable underground temperature to provide heating, cooling, and hot water for your home, offering high efficiency.

- Small Wind Energy Property: Wind turbines installed on your property to generate electricity for residential use.

- Battery Storage Technology: For systems installed starting in 2023, battery storage with a capacity of at least 3 kilowatt-hours is also eligible, allowing homeowners to store excess renewable energy.

There are no annual or lifetime dollar limits on the credit amount for most of these technologies, which is a key advantage. This means you can claim 30% of the cost, regardless of how large your system is or how much it costs, as long as it meets the qualification criteria. This credit is available each year you make eligible improvements, allowing for phased installations.

The Residential Clean Energy Credit is a cornerstone of the IRA’s efforts to promote renewable energy adoption among homeowners. By offering a substantial tax reduction for a wide range of technologies, it significantly lowers the financial barrier to entry, making sustainable living more attainable for many U.S. households.

Energy Efficient Home Improvement Credit (Section 25C)

Beyond the direct renewable energy systems, the Inflation Reduction Act also significantly bolsters incentives for broader home energy efficiency improvements through the Energy Efficient Home Improvement Credit, detailed in Section 25C. This credit is designed to encourage homeowners to make upgrades that reduce energy consumption, thereby lowering utility bills and decreasing their carbon footprint.

Unlike the Residential Clean Energy Credit, Section 25C has annual limits, but these limits are now more generous under the IRA. For improvements made in 2023 and beyond, homeowners can claim a credit equal to 30% of the cost of eligible home improvements, up to a maximum of $1,200 annually. This annual cap allows homeowners to plan multiple smaller projects over several years and still benefit from the credit each time.

Qualified Energy Efficiency Home Improvements

The range of improvements covered by Section 25C is extensive, focusing on the building envelope and various energy-efficient equipment. These are upgrades that directly contribute to making your home better insulated and more efficient in its heating and cooling.

- Insulation Materials: Any insulation product designed to reduce heat loss or gain, including loose-fill, batt, rigid board, and spray foam.

- Exterior Doors: Energy Star certified exterior doors are eligible, with an annual credit limit of $250 per door and a total annual limit of $500 for all doors.

- Exterior Windows and Skylights: Energy Star certified windows and skylights qualify, with an annual credit limit of $600.

- Central Air Conditioners, Furnaces, and Water Heaters: Highly efficient models, including natural gas, propane, or oil furnaces and boilers, and electric or natural gas heat pump water heaters, are eligible.

- Heat Pumps and Biomass Stoves/Boilers: Electric or natural gas heat pumps, as well as biomass stoves and boilers that meet specific efficiency standards, are also covered. These specific items have a higher annual limit of $2,000 within the overall $1,200 cap.

It’s important to note that the equipment must be new and expected to remain in use for at least five years. Additionally, the credit applies to the cost of the property itself, as well as installation costs. Homeowners should keep detailed records of all expenses and certifications for eligible products.

The Energy Efficient Home Improvement Credit is a fantastic opportunity for homeowners to make their homes more comfortable and less expensive to operate. By covering a significant portion of the costs for a wide array of energy-saving upgrades, the IRA empowers individuals to invest in their homes’ long-term efficiency and environmental performance.

New Home Energy Efficient Home Credit (Section 45L)

While many IRA incentives target existing homeowners, the New Home Energy Efficient Home Credit (Section 45L) is specifically designed to encourage builders and contractors to construct new homes that meet stringent energy efficiency standards. Although not a direct homeowner credit in the same way as 25D or 25C, it indirectly benefits homeowners by increasing the availability and affordability of highly efficient new homes.

This credit provides a financial incentive to developers for building homes that are significantly more energy-efficient than typical new constructions. For homes acquired after December 31, 2022, and before January 1, 2033, the credit amount can be substantial, depending on the energy efficiency level achieved and whether the home is ENERGY STAR certified or ZERH (Zero Energy Ready Home) certified.

How it Benefits Homeowners

Even though the credit is claimed by the builder, homeowners are the ultimate beneficiaries. When builders receive this credit, it can lead to several advantages for those purchasing new homes:

- Lower Purchase Prices: Builders might pass on some of their savings from the tax credit in the form of lower home prices or added features.

- Reduced Utility Bills: A new home built to higher energy efficiency standards will naturally have lower heating, cooling, and electricity costs from day one.

- Enhanced Comfort: Better insulation, windows, and HVAC systems in an energy-efficient home contribute to a more comfortable living environment with fewer drafts and more consistent temperatures.

- Environmental Impact: Living in an energy-efficient new home means a smaller carbon footprint and a contribution to broader environmental goals.

For single-family homes, the credit can be up to $2,500 for ENERGY STAR certified homes and up to $5,000 for ZERH certified homes, provided they meet specific energy performance requirements. These certifications ensure that the homes are built with superior insulation, high-performance windows, efficient HVAC systems, and other energy-saving features.

The New Home Energy Efficient Home Credit plays a crucial role in transforming the housing market towards greater sustainability. By incentivizing builders to adopt advanced energy-saving practices, it ensures that new homes are not only modern but also environmentally responsible and cost-effective for their occupants in the long run. Homebuyers should inquire about these certifications when considering new construction.

The Alternative Fuel Vehicle Refueling Property Credit (Section 30C)

As electric vehicles (EVs) become increasingly popular, the infrastructure to support them is becoming just as important. The Inflation Reduction Act recognizes this need by extending and modifying the Alternative Fuel Vehicle Refueling Property Credit, found in Section 30C. This credit is designed to make it more affordable for homeowners to install EV charging stations (and other alternative fuel infrastructure) at their residences.

Previously, this credit had expired or was limited. However, the IRA revitalizes it, offering a credit of 30% of the cost of qualified alternative fuel vehicle refueling property, up to a maximum of $1,000. This incentive covers the cost of both the charging equipment itself and the labor costs for its installation. This is a significant benefit for homeowners looking to future-proof their homes for electric vehicle ownership.

What Qualifies for the 30C Credit?

For homeowners, the primary focus of the 30C credit will be on electric vehicle charging equipment. To qualify, the property must be for the refueling of vehicles propelled by electricity or other alternative fuels, and it must be installed in a qualified location. For residential use, this typically means a charging station installed at your primary residence.

- EV Charging Stations: Level 2 (240-volt) chargers are the most common and beneficial for home use, allowing for faster charging than standard wall outlets.

- Installation Costs: The credit covers the costs associated with the electrical work required to install the charger, including wiring, circuit breakers, and permits.

- Property Requirements: The charging equipment must be new and placed in service after December 31, 2022, and before January 1, 2033. It must also be installed in a location within the United States.

It’s important to keep meticulous records of your purchase and installation costs, as these will be necessary when claiming the credit on your federal tax return. This credit is a non-refundable personal credit, meaning it can reduce your tax liability but won’t result in a refund beyond what you owe.

The Alternative Fuel Vehicle Refueling Property Credit is a forward-thinking incentive that supports the growing adoption of electric vehicles. By making home charging more affordable, the IRA encourages a seamless transition to cleaner transportation, further integrating renewable energy and sustainable practices into daily life for U.S. homeowners.

IRA Rebate Programs: High-Efficiency Electric Home Rebate Program (HEEHRP)

Beyond the tax credits, the Inflation Reduction Act also introduced significant rebate programs, which operate differently from tax credits but are equally valuable for homeowners. One of the most impactful is the High-Efficiency Electric Home Rebate Program (HEEHRP). Unlike tax credits, which reduce your tax bill, rebates provide upfront discounts at the point of sale or installation, making the immediate cost of upgrades much lower.

HEEHRP is designed to help low- and moderate-income households electrify their homes and improve energy efficiency. The program is administered by state energy offices, and the exact availability and implementation details will vary by state. Homeowners can receive up to $14,000 in rebates for various electric home upgrades, significantly reducing the financial barrier to adopting these technologies.

Eligible Rebates and Income Qualifications

The rebates cover a wide array of electric appliances and home improvements, focusing on electrification and energy efficiency. The amount of the rebate you can receive depends on your household income relative to the area median income (AMI).

- Up to $8,000 for Heat Pump HVAC: This is a major rebate for installing efficient electric heat pumps for heating and cooling.

- Up to $1,750 for Heat Pump Water Heaters: For switching to an energy-efficient electric water heater.

- Up to $840 for Electric Stoves, Cooktops, Ovens, or Heat Pump Clothes Dryers: Encouraging a move away from natural gas appliances.

- Up to $4,000 for Electrical Panel Upgrades: Often necessary to support new electric appliances.

- Up to $1,600 for Insulation, Air Sealing, and Ventilation: Crucial for overall home energy efficiency.

- Up to $2,500 for Wiring Upgrades: To facilitate the installation of new electric systems.

For households with incomes less than 80% of the AMI, 100% of the project costs up to the maximum rebate amount are covered. For households with incomes between 80% and 150% of the AMI, 50% of the project costs are covered, up to the maximum rebate amount. Households above 150% AMI are not eligible for HEEHRP, but they can still utilize the tax credits (Sections 25D and 25C).

It’s crucial for homeowners to contact their state energy office or local utility provider to understand the specific availability and application process for HEEHRP, as these programs are still rolling out. These rebates represent a transformative opportunity for many households to affordably transition to a fully electric, energy-efficient home, significantly lowering their energy burden and environmental impact.

Maximizing Your IRA Benefits: Strategies and Considerations

Successfully navigating the various tax credits and rebates offered by the Inflation Reduction Act requires a strategic approach. Homeowners can combine different incentives, but understanding the nuances of each program is key to maximizing overall benefits. It’s not just about knowing what’s available, but also how to best utilize these opportunities in conjunction with your specific home improvement plans.

One primary strategy involves planning your home upgrades to take advantage of both the tax credits and, if eligible, the rebate programs. For instance, a low- or moderate-income homeowner could potentially use HEEHRP rebates for a heat pump installation and then claim the 25D tax credit for solar panels. Careful sequencing and documentation are paramount to ensure you meet all eligibility requirements.

Key Strategies for Homeowners

To fully capitalize on the IRA’s offerings, consider these practical steps and considerations:

- Consult with Professionals: Engage with qualified contractors who are knowledgeable about IRA incentives. They can help identify eligible products and ensure installations meet specific standards.

- Keep Meticulous Records: Save all receipts, invoices, product specifications, and certifications for eligible purchases and installations. This documentation is crucial for claiming tax credits and applying for rebates.

- Understand Income Limitations: Be aware of income thresholds for rebate programs like HEEHRP. Even if you don’t qualify for rebates, you likely still qualify for tax credits.

- Check State and Local Programs: The IRA’s federal incentives can often be combined with existing state and local energy efficiency programs, further increasing your savings. Research what’s available in your specific area.

- Plan for Future Upgrades: Since some credits (like 25C) are annual, consider phasing in large projects over several years to maximize your yearly claims.

Another important consideration is the timing of your installations. To qualify for the most generous credit amounts, installations must typically occur within the specified timeframe, generally from 2023 through 2032. Staying informed about any potential updates or changes to the legislation is also advisable, though the core provisions are expected to remain stable for the foreseeable future.

Maximizing your IRA benefits involves a combination of careful planning, thorough documentation, and leveraging expert advice. By strategically approaching your renewable energy and energy efficiency upgrades, U.S. homeowners can significantly reduce costs, enhance their home’s value, and contribute to a more sustainable energy future.

Future Outlook and Long-Term Impact of the IRA

The Inflation Reduction Act is not merely a collection of temporary incentives; it represents a long-term commitment by the U.S. government to accelerate the clean energy transition. The provisions for renewable energy tax credits and rebates extend for a decade, providing stability and predictability for homeowners and the clean energy industry alike. This long-term outlook is crucial for encouraging widespread adoption and fostering innovation in sustainable technologies.

The IRA’s impact is expected to be profound, shifting consumer behavior and driving down the cost of renewable energy solutions over time. As more homeowners invest in solar, heat pumps, and other efficient technologies, economies of scale will likely lead to further price reductions, making these options even more attractive. This creates a virtuous cycle where incentives drive adoption, which in turn drives down costs and increases accessibility.

Anticipated Long-Term Benefits

Looking ahead, the long-term benefits of the IRA for U.S. homeowners and the nation are substantial:

- Energy Independence: Reduced reliance on volatile fossil fuel markets and increased domestic energy production from renewable sources.

- Economic Growth: Creation of new jobs in the clean energy sector, from manufacturing and installation to research and development.

- Improved Public Health: Lower air pollution from reduced fossil fuel combustion, leading to better health outcomes for communities.

- Climate Resilience: A more robust and diversified energy grid, better equipped to handle extreme weather events and climate change impacts.

- Innovation: Continued investment and research into next-generation renewable energy and energy storage technologies.

Homeowners who leverage these incentives are not just saving money; they are actively participating in a national effort to build a more sustainable and resilient future. The act’s provisions are designed to ensure that the U.S. remains a leader in clean energy technology and deployment, setting a precedent for other nations.

The future outlook for renewable energy adoption in U.S. homes is exceptionally bright, thanks to the comprehensive support provided by the Inflation Reduction Act. The long-term nature of these incentives ensures that homeowners have ample opportunity to plan and execute their energy-efficient upgrades, contributing to a greener, more economical, and more sustainable home and country for generations to come.

| IRA Incentive Type | Brief Description for Homeowners |

|---|---|

| Residential Clean Energy Credit (25D) | 30% tax credit for solar, geothermal, small wind, and battery storage installations. No annual limit. |

| Energy Efficient Home Improvement Credit (25C) | 30% tax credit for energy-efficient upgrades (insulation, windows, heat pumps), up to $1,200 annually. |

| Alternative Fuel Vehicle Refueling Property Credit (30C) | 30% tax credit for EV charging station installation costs, up to $1,000. |

| High-Efficiency Electric Home Rebate Program (HEEHRP) | Up to $14,000 in upfront rebates for electric appliances and efficiency upgrades for eligible low- to moderate-income households. |

Frequently Asked Questions About IRA Renewable Energy Credits

The primary benefit is making renewable energy and energy-efficient home improvements significantly more affordable through generous tax credits and rebates. This reduces upfront costs and leads to long-term savings on utility bills, while also contributing to environmental sustainability.

Yes, you can often combine different IRA tax credits, such as the Residential Clean Energy Credit (25D) for solar panels and the Energy Efficient Home Improvement Credit (25C) for insulation. However, specific rules apply, and it’s wise to consult a tax professional for personalized advice.

Income limitations primarily apply to the High-Efficiency Electric Home Rebate Program (HEEHRP), which targets low- and moderate-income households. Most tax credits, like the 25D and 25C credits, do not have income thresholds, making them accessible to a broader range of homeowners.

Most of the significant tax credits, including the Residential Clean Energy Credit (25D) and the Energy Efficient Home Improvement Credit (25C), are extended through 2032. The rebate programs are also designed for long-term implementation, typically through 2032, providing stable incentives.

It is crucial to keep detailed records. This includes invoices for purchases and installations, product certifications, and any other relevant documentation that proves eligibility. These documents will be necessary when filing your taxes or applying for state-administered rebates.

Conclusion

The 2026 Inflation Reduction Act presents an unparalleled opportunity for U.S. homeowners to invest in renewable energy and energy-efficient home improvements. By understanding and strategically utilizing the five key tax credits and associated rebate programs, homeowners can significantly reduce their financial outlay while enjoying long-term savings on utility bills. This landmark legislation not only makes sustainable living more accessible but also plays a pivotal role in accelerating the nation’s transition to a clean energy future, benefiting both individual households and the environment for years to come.